Comparing the Best Secured Credit Card Singapore Options for 2024

Comparing the Best Secured Credit Card Singapore Options for 2024

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit Report Cards Following Discharge?

Navigating the monetary landscape post-bankruptcy can be a challenging task for individuals wanting to reconstruct their credit rating. One typical inquiry that arises is whether former bankrupts can effectively get credit scores cards after their discharge. The solution to this questions involves a multifaceted exploration of different variables, from credit scores card choices customized to this demographic to the impact of past monetary choices on future credit reliability. By understanding the complexities of this procedure, people can make informed decisions that may lead the way for a more secure monetary future.

Understanding Credit History Card Options

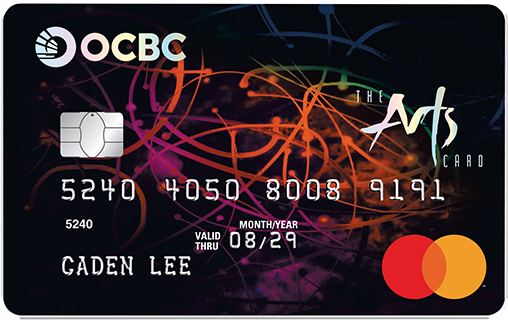

When thinking about debt cards post-bankruptcy, people should carefully analyze their requirements and economic situation to select the most ideal alternative. Guaranteed credit score cards, for circumstances, call for a cash money down payment as collateral, making them a viable option for those looking to restore their credit score history.

Moreover, people ought to pay close focus to the interest rate (APR), moratorium, annual fees, and benefits programs used by various credit report cards. APR determines the price of obtaining if the balance is not paid in full each month, while the moratorium figures out the home window throughout which one can pay the equilibrium without sustaining passion. Additionally, yearly costs can impact the overall cost of owning a debt card, so it is crucial to evaluate whether the benefits outweigh the fees. By comprehensively assessing these elements, individuals can make educated decisions when choosing a charge card that straightens with their economic objectives and conditions.

Elements Impacting Authorization

When applying for credit cards post-bankruptcy, understanding the elements that influence approval is essential for individuals seeking to reconstruct their financial standing. Adhering to an insolvency, credit history scores typically take a hit, making it more difficult to qualify for traditional credit scores cards. Demonstrating liable economic habits post-bankruptcy, such as paying bills on time and keeping credit application reduced, can likewise positively affect credit card authorization.

Secured Vs. Unsecured Cards

Understanding the differences between unsecured and protected bank card is critical for individuals post-bankruptcy seeking to make informed decisions on reconstructing their monetary health. Protected bank card need a money deposit as security, generally equivalent to the credit line extended by the provider. This down payment minimizes the threat for the charge card company, making it a practical option for those with a background of personal bankruptcy or inadequate credit score. Safe cards commonly come with lower credit history limits and higher rate of interest compared to unprotected cards. On the other hand, unsecured credit scores cards do not require a cash money deposit and are based solely on the cardholder's creditworthiness. These cards typically use higher debt limits and reduced rate of interest for individuals with excellent credit rating. Nevertheless, post-bankruptcy people might find it testing to certify for unprotected cards right away after discharge, making safe cards a more viable alternative to start restoring credit. Inevitably, the choice in between secured and unsecured credit rating cards depends on the person's monetary situation and credit rating objectives.

Structure Credit History Sensibly

To successfully restore credit scores post-bankruptcy, developing a pattern of liable credit rating usage is necessary. One vital means to do this is by making prompt payments on all credit history accounts. Settlement background is a substantial consider determining credit report, so making sure that all expenses are paid in a timely manner can progressively enhance creditworthiness. In addition, maintaining bank card equilibriums low about the credit rating limit can favorably influence credit rating. secured credit card singapore. Specialists advise keeping credit report use below 30% to demonstrate liable debt monitoring.

One more strategy for constructing credit history responsibly is to keep an eye on credit report reports consistently. By examining credit scores records for errors or indicators of identity burglary, individuals can deal with concerns quickly and preserve the precision of their credit rating. Furthermore, it is suggested to avoid opening up multiple new accounts at as soon as, as this can indicate economic instability to potential loan providers. Rather, concentrate on slowly branching out charge these details account and demonstrating regular, liable credit score behavior in time. By complying with these techniques, people can gradually rebuild their credit report post-bankruptcy and job in the direction of a healthier financial future.

Gaining Long-Term Conveniences

Having established a structure of accountable credit report monitoring post-bankruptcy, individuals can now concentrate on leveraging their enhanced credit reliability for long-lasting financial advantages. By regularly making on-time payments, maintaining credit report usage reduced, and checking their credit report reports for precision, former bankrupts can progressively reconstruct their credit rating. As their credit report scores boost, they may become qualified for better bank card supplies with lower rate of interest and greater credit line.

Reaping lasting take advantage of enhanced creditworthiness prolongs past just charge card. It opens doors to desirable terms on fundings, home mortgages, and insurance coverage costs. With a strong credit history, people can negotiate better rates find more of interest on lendings, possibly conserving hundreds of dollars in rate of interest repayments gradually. Additionally, a positive debt profile can enhance task potential customers, as some companies might check credit history records as component of the working with procedure.

Conclusion

To conclude, previous bankrupt people may have problem securing bank card adhering to discharge, but there my latest blog post are options available to help restore credit rating. Comprehending the different kinds of charge card, factors affecting authorization, and the importance of responsible credit scores card usage can assist individuals in this situation. By choosing the best card and using it responsibly, former bankrupts can gradually improve their credit rating and reap the lasting advantages of having accessibility to credit rating.

Demonstrating liable economic habits post-bankruptcy, such as paying expenses on time and keeping credit scores usage low, can additionally favorably influence credit scores card authorization. In addition, maintaining credit score card equilibriums low loved one to the debt limitation can positively influence debt ratings. By regularly making on-time settlements, maintaining credit history usage low, and monitoring their debt records for accuracy, previous bankrupts can gradually restore their credit report scores. As their debt scores raise, they may come to be eligible for much better credit score card provides with reduced rate of interest prices and higher debt limitations.

Recognizing the different kinds of credit rating cards, aspects impacting approval, and the value of responsible credit score card usage can assist people in this situation. secured credit card singapore.

Report this page